- Current Location:

- Home>

- Investing/ASEAN>

- Singapore

Singapore company registration

All companies in Singapore must be registered with the Accounting and Corporate Regulatory Authority (ACRA).

I. Types of companies in Singapore.

1. Sole proprietorship, partnership, limited liability partnership, limited partnership

(1) Sole proprietorship: There is only one owner, and sole proprietorship is not a legal entity.

(2) Partnership business: a business structure consisting of more than one person or one company

(3) Limited Liability Partnership (LLP): Limited Liability Company + Partnership

(4) Limited partnership: A limited partnership is not an independent legal entity, and a partner who is not responsible for managing a limited partnership only has to bear limited personal legal liability.

2. Private limited company, public company (listed company): A legal entity required by the Singapore Companies Act.

(1) Excluded Private Limited (EPC) with no more than 20 shareholders.

(2) 21-50 shareholders of private limited company

(3) Public stock company with more than 50 shareholders (non-listed public companies and listed public companies)

(4) Public guarantee company with more than 50 shareholders (non-listed public companies and listed public companies)

II. Establishment of PTE.LTD, a private limited company.

The Singapore Company ACT 50 provides that any person of any nationality who has reached the age of 18 may establish a Singapore Private Limited.

Company name: Singapore company name is English, ending with PTE. LTD., means "private limited company".

Issue capital: Singapore company issues capital (issue shares) at least 1 yuan (can be S $or US dollars), fully paid up capital 1 yuan (that is, the amount of shares subscribed, but Singapore dollars can also be US dollars).

Registered address: Singapore company must have a legally registered address (provided by Hengxin Pacific).

Legal Secretary: the legal Secretary of the Company must be appointed 6 months after the establishment of the company (provided by Hengxin Pacific).

Activites: each company can only choose 2 business areas.

Shareholder directors: provisions for shareholders and directors of Singapore companies.

1. The Singapore Company Law stipulates that shareholders can be natural persons or enterprise legal persons (legal shareholders).Natural shareholder unlimited nationality (may also serve as a director). Corporate shareholders are not limited to the place of registration (overseas or offshore companies can).

2. At least one director of a Singapore company. To set up a company in Singapore, foreigners need at least one Singaporean resident director (commonly known as a "registered director" provided by ERI).

Registration process: application process and time of Singapore Private Limited.

1. Fill in the Application form for registered companies in Singapore, sign the Service Agreement and pay the deposit.

2. Name check: check the name with the ACRA Registration Board.

3. ERI legal Secretary prepares to register legal documents for signature by clients.

4. The customer document was signed and scanned and sent back to Hengxin Pacific, and the original was then sent to Hengxin Pacific.

5. Henderson Pacific legal Secretary applies for Electronic filing to Accounting and Corporate Regulatory Authority "ACRA" on behalf of the client.

6. Application for approval-the maximum time for the whole journey is 1 working day.

Registration documents: documents required for the registration of Singaporean companies.

1. Photocopy of ID card and passport.

2. The name and scope of business of the company.

3. Articles of Association, first Director's Resolution and Director's affidavit (provided by Hengxin Pacific).

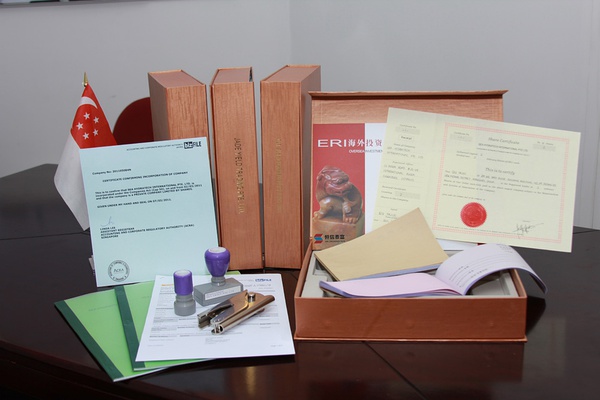

Documents obtained after the establishment of the Singapore company:

1. One original certificate of registration issued by the Accounting and Business Control Board of Singapore (electronic version);

2. 2 original shares per shareholder of Singapore company;

3. A copy of Singapore company search information BIZFILE (date of establishment, registered address, issue and paid-up capital, directors, shareholders, shares and secretaries, etc.).

4. 5 copies of Singapore articles of association, 1 commercial seal (offset printing), 1 receipt, one company kit briefcase

Singapore corporate bank account: after the establishment of Singapore company, you can open accounts with major banks in Singapore (recommended overseas Chinese bank OCBC and Dahua bank UOB). It takes about 14 working days to open an account.

Singapore companies must pay attention to operational compliance: Singapore companies are not allowed to conduct any business activities with the following sensitive countries.

1.Korea 2.Congo 3.Eritrea 4.Iran 5.Libya. 6.Somalia 7.South Sudan 8.Sudan 9.Yemen

Statutory audit of Singapore company: with effect from January 1, 2018, the operating income is equal to or greater than S $10 million, or the total assets are equal to or exceed S $10 million, or the number of employees is equal to or exceeds 50. A statutory audit and the appointment of an auditor are required to reach any two of the three articles.

Singapore Corporate Taxation: Singapore is a territorial taxing country. Overseas profits are tax-free! The basic tax rate is 17%. For companies with access to the Global Trader Program GTP, the tax rate can be as low as 5 per cent for five years in a row! Singapore companies have an annual tax return system.

Singapore company annual report: Singapore company annual report system. The new company is required to submit its annual financial report and tax report (commonly known as the "Annual report") within 18 months. The fiscal year can be drawn up on its own.

Singapore work visa: foreigners who come to Singapore operations and management companies are required to apply for a work visa, that is, an employment permit or an entrepreneur permit (starting from S $3600, there is no English requirement). Short-term round trip can apply for a short-term visa VISA (stay for 5 weeks).

Singapore immigrants: successful application for employment permit, stay in Singapore for more than 183 days / year, you can apply for Singapore tax residents! Avoid CSR risk! You can also apply for a permanent resident PR green card! The whole family emigrated to Singapore! Naturalization of Singapore: successful application for Singapore permanent resident Permanent Resident green card for 2 years, you can apply to become a Singaporean citizen. Enjoy visa-free entry to more than 160 countries!

NEXT:无

- Why Choose Singapore

- 10 Advantages of Singapore formation

- Tax Exemptions for Singapore Statrups

- Why Choose ERI

- We are Chartered Accountant

- We are Chartered Secretary

- 20 years'experience,served 8000+clients

- Strategic Partners

- Singapore UOB

- Singapore OCBC

- Newsletter Subscription

- Government,Business,Funding,Listing,Finance

- Weekly updates,welcome to subscribe FOC

- Partne with us

- Opportunities for mutual prosperity

0065-62250588

0065-62250588